Dr Thomas Verbeek, University of Warwick @thverbeek

In our contemporary globalized economy, it is increasingly complex to disentangle the relationships between different places, different companies and different products. Through global production networks, globally operating conglomerates, global elite networks as well as through all kinds of inter-firm alliances such as joint ventures and license agreements, different companies and different places are invisibly tied together across time and space.

Multinational corporations play a substantial role in this networked global economy, operating at the intersection of a global reach and local embeddedness. For industries that are dominated by relatively few global players, such as the (petro)chemical industry, these multinational corporations often consist of a hierarchical network with hundreds of subsidiary companies, all over the world. This means that a chemical production plant in Antwerp, the biggest petrochemical hub in Europe, will probably be part of a multinational corporation with other plants in Europe, the US, China, and other parts of the world. How these different subsidiaries and places are connected in a global corporate network, and where ultimately the decision-making strategic power is executed, is not easy to unravel.

It becomes particularly interesting to look into these spatial corporate networks considering the profound changes that are taking place in our global economy today. China and other emerging economies – like India and Brazil – are reshaping the flows of production, labour and capital around the world (Morgan & Whitley, 2012). While this applies to many sectors, in the context of our “Toxic Expertise” research project we particularly look into the petrochemical industry.

Despite globalization, until recently the global (petro)chemical industry had been remarkably stable in terms of the geographical and corporate leadership of the US and Western Europe, especially when compared with other knowledge-based, high technology industries (Chandler, 2009). The major enterprises in 2002 still included some of the traditional leaders that had secured their market dominating positions well before the Second World War (such as BASF in Germany and Dow Chemical in the US), joined by some early Asian competitors that emerged in the 1970s and 1980s (such as Saudi Arabia’s Sabic and Japan’s Mitsubishi Chemical). It is only in the past decade that we have seen profound geographical changes, with China overtaking the US and Europe as the largest chemical producer, and other emerging markets (India, Brazil) also expanding rapidly.

While the European Union, NAFTA and Japan maintained global dominance in 2007, with a combined share of 57.8% in world chemicals sales, this share plummeted to only 35% in 2017. In the same decade, China has grown to be the largest petrochemical producer, with its share having increased from 14.8% to 37.2%. While still lagging behind substantially, also India saw a relatively big increase from 2.1 to 2.9% (CEFIC, 2018).

These numbers show that (petro)chemical production is undeniably moving away from its traditional heartlands. However, this does not mean that patterns of Western corporate leadership and decision-making power are also shifting. Taking a look at the list of the world’s biggest (petro)chemical producers in 2016, we see that for the most part the traditional companies from established high income economies dominate the list. However, we also see China’s state-owned petrochemical producer Sinopec taking third place, and five other companies from so-called Newly Industrialized Countries (NICs) or Emerging Economies (EE) making the Top 50 list. This shows that change in global corporate leadership is following the change in places of production, but at a much slower pace.

Table 1. Top 10 (petro)chemical companies in 2016 and 5 additional Top 50 companies from Emerging Economies (Note: Dow Chemical and Du Pont considered as a merged company) (Source: Chemical & Engineering News)

| 2016 ranking | Company | HQ location |

Chemical sales

($ millions) |

| 1 | DowDuPont | US | $67,837 |

| 2 | BASF | Germany | $60,654 |

| 3 | Sinopec | China | $42,815 |

| 4 | SABIC | Saudi Arabia | $30,986 |

| 5 | Formosa Plastics | Taiwan | $27,141 |

| 6 | ExxonMobil | US | $26,058 |

| 7 | LyondellBasell | Netherlands | $24,624 |

| 8 | Ineos | Switzerland | $23,530 |

| 9 | Mitsubishi Chemical | Japan | $23,358 |

| 10 | Air Liquide | France | $19,554 |

| … | … | … | … |

| 17 | Reliance Industries | India | $13,769 |

| 18 | Braskem | Brazil | $13,692 |

| 40 | Indorama | Thailand | $7,220 |

| 42 | Sasol | South Africa | $7,148 |

| 48 | PTT Global Chemical | Thailand | $6,151 |

However, these rankings do not give a full picture of the situation. A further exploration of the spatial, social, and organizational networks behind the figures would provide more insight in the changes that are taking place or that are on the way. In a forthcoming publication, we apply social, spatial and inter-firm network analysis to provide a detailed overview. In this supplementary contribution, we focus on mapping the spatial corporate networks, as a way of visually analysing the geographical scope and spatial structure of individual and combined corporate networks.

Spatial Network Analysis

To entangle the complex spatial relationships of multinational global corporate networks, different fields of economic geography have applied network analysis, examining global production networks (e.g. Bridge, 2008) and world city networks (e.g. Alderson & Beckfield, 2004). We particularly build on techniques developed in the latter field, where networks based on headquarter-subsidiary ties of transnational corporations enable researchers to identify the most powerful or strategic cities or countries. The results usually show that a few global cities and a few predominantly Western countries have a disproportionate importance in the global economic network (Wall, Burger & Van der Knaap, 2011).

However, these analyses usually focus on large samples of multinational service sector firms. Research on the spatial corporate networks of resource dependent and capital-intensive manufacturing industries, as well as analysis of the spatial network within a large corporation, is still rare. A particular exception is the spatial network analysis applied to multinational oil corporations in a study by Yang and Dong (2016), showing that international oil companies and (state-owned) national oil companies had different location preferences and different spatial networks.

In this contribution, we want to map the spatial corporate networks of the petrochemical industry. We want to visually examine (1) how individual spatial corporate networks differ from each other in terms of complexity, geographical scope and centralization; (2) where the decision-making power of the Top 10 companies is concentrated; and (3) whether and how spatial networks of corporations from emerging economies integrate with the established network. Thus, our analysis does explicitly not want to uncover patterns of production, but focuses on revealing the power structures and places of strategic importance in the global petrochemical network.

We focus our analysis on the ten largest (petro)chemical companies in sales value in 2016, expanded with four companies from emerging economies (Table 1) (Note: we omitted Indorama to retain only one company from Thailand, ensuring a varied sample). For every corporation, we exported the hierarchical structure of all subsidiaries from Orbis, a global company database with information on around 300 million companies worldwide, all standardised for cross-border comparisons. For each corporation, the exported network contained all subsidiaries that are majority-owned (thus excluding 50:50 joint ventures and other entities with less than 50% shares). To correctly map the corporate networks, subsidiary location data was validated and completed. It should be noted that setting up subsidiaries can have different motivations (e.g. availability of resources, production costs, access to markets, tax evasion) and not always equals production activity. Moreover, registered addresses of subsidiary companies are not always the places where most activity of the subsidiary is carried out (though usually this is the case). Finally, locations were aggregated at the metropolitan level, if applicable, to allow for a functional rather than an administrative or political interpretation of a city. These limitations mean that the spatial corporate networks should be interpreted with caution and can only be used to gain a general overview, not as a base for detailed examination of specific locations.

The final dataset allows to map the spatial network of every corporation, based on the location of all subsidiaries, and the ownership ties between different subsidiaries. By combining in- and outgoing ownership ties for every city, a degree can be calculated. It can be interpreted as a measure for the strategic importance of a city for the corporate network, with global and regional headquarter locations having the highest degree. When the networks of corporations are combined, the degree equals the significance of particular cities as powerful hubs for the flows of capital.

Results

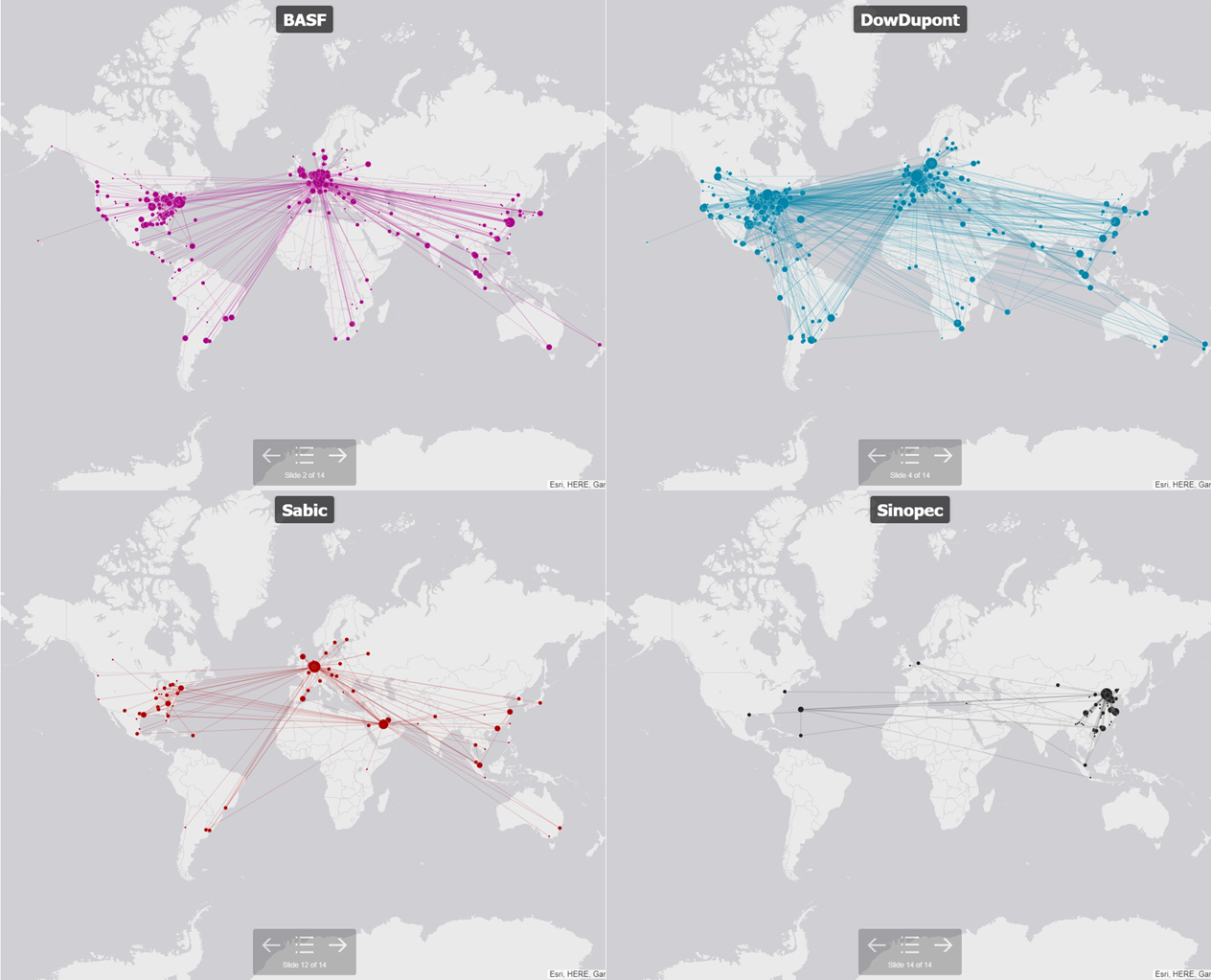

Figure 1. The different spatial extent and complexity of the corporate networks of BASF, DowDupont, Sabic and Sinopec. Node size represents degree of a city, edges represent ownership ties. (click here for the online interactive maps of the fourteen corporations)

In a first series of interactive maps we map the fourteen spatial corporate networks individually. For every corporation, these maps give an idea of the spatial reach of their activities, the location of the most important places of decision and the flows of power within their network (Figure 1). A comparison of these maps shows interesting similarities and differences in terms of spatial extent, complexity and hierarchical structure of the corporate networks. The traditional corporations like BASF and DowDupont, with their roots in the early 20th century or before, generally have a truly global reach with hundreds of subsidiaries in a complex corporate network. While their global headquarters locations and home countries capture a big part of their decision power, this power is for a substantial part distributed across secondary strategic locations, mainly situated in the traditional “petrochemical heartlands” of Europe and North America. Another group of companies consists of the early Asian competitors that emerged in the 1960s and 1970s, with Saudi Arabia’s Sabic and Japan’s Mitsubishi Chemical being the best examples. While still having a large part of their activities and decision power centred on their home regions, their corporate networks resemble the networks of the traditional corporations, having spread out to other parts of the world with a strong presence in Europe and North America today. Finally, the five emerging economy corporations in our sample show a varied picture. For all five corporations, their spatial reach goes beyond their home country, but Reliance Industries and Sasol are clearly the most global, with an extensive network of subsidiaries that is largely controlled from their home base. Sinopec has a comparable hierarchical network with many subsidiaries, but almost all activity is situated within China’s borders, controlled from Beijing. Finally, Braskem and PTT Global Chemical have a limited local and global network with few subsidiaries. Overall, we find that high income economy corporations generally have a less hierarchical corporate network with many subsidiaries, centred on Europe and North America, with South and East Asia playing an important secondary role. Their international strategy and flat organizational structure is in most cases not only the result of natural growth of the company, but also reflects a long history of mergers and acquisitions. On the other hand, most companies from emerging economies have a more hierarchical and less complex corporate structure, with different spatial strategies but always a strong presence in the home region.

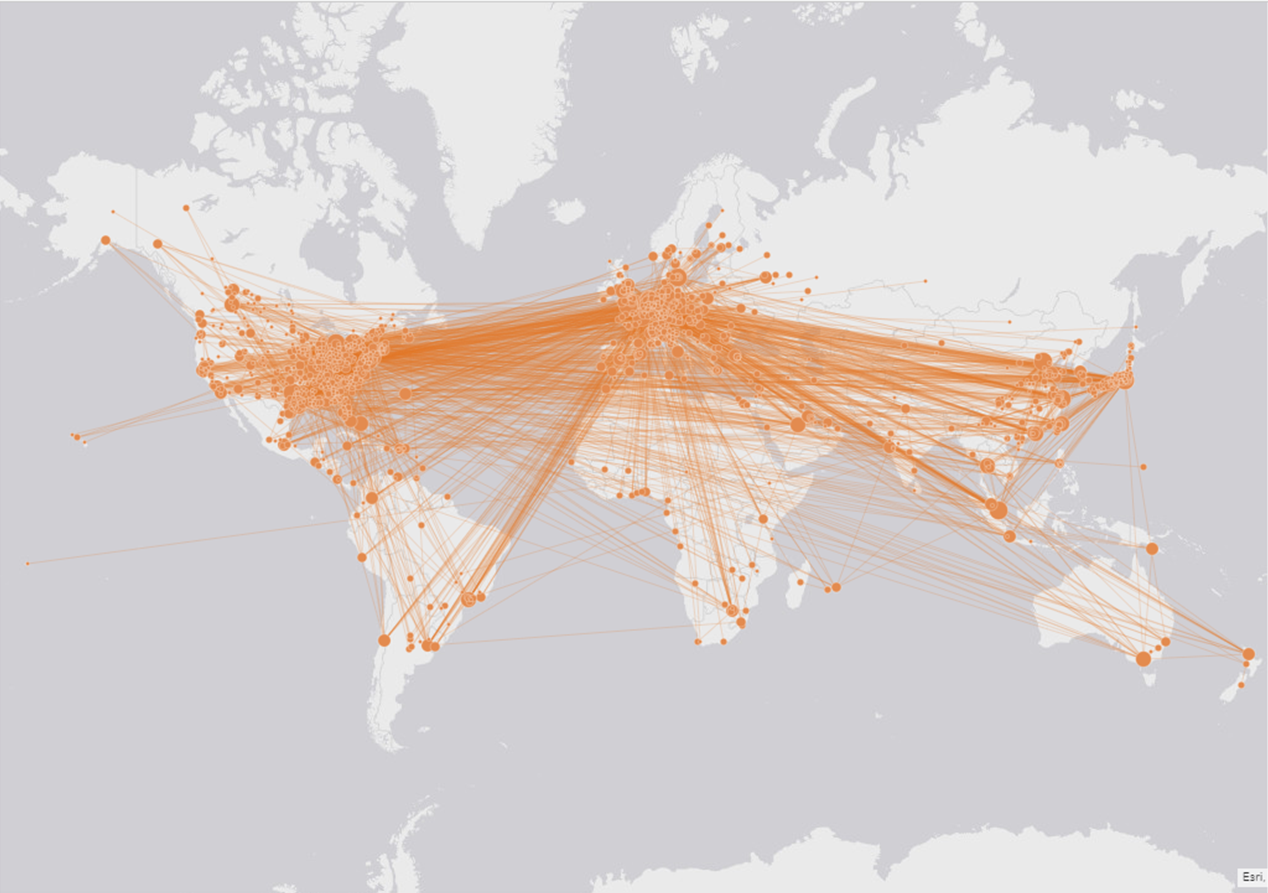

Figure 2. The combined corporate network of the global Top 10 petrochemical corporations (click here for the online interactive map)

A second map looks at of the combined network of the Top 10 petrochemical corporations in 2016, representing a combined sales value of almost $350bn. This combined network gives an idea of the most powerful and strategic regions and cities in today’s petrochemical industry. The network is dominated by Western Europe and the Eastern part of the United States, the two regions where the petrochemical industry originated. We also see a secondary regional hub of power in Eastern Asia, centred on China, Japan and Taiwan. Apart from the three core regions, many important regional poles can be discerned, but Africa, South America and Oceania clearly have limited power in the global petrochemical network.

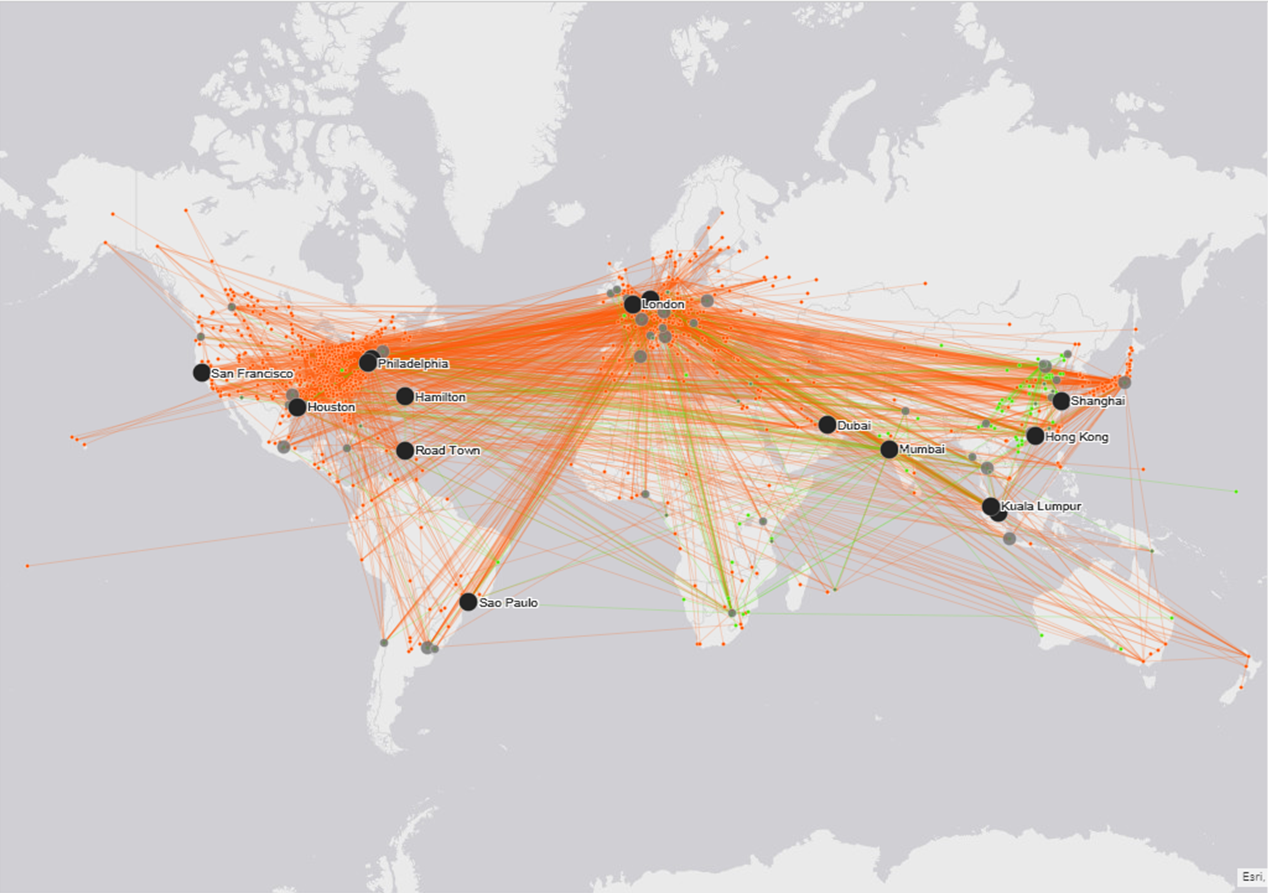

Figure 3. The integration of High Income Economy corporate networks (red) and Emerging Economy corporate networks (green) with indication of the fifteen most important “connection nodes” (black) and other “connection nodes” of lesser importance (grey)

While the situation today might still reflect the traditional patterns and power relations that are rooted in the early twentieth century, a look at the networks of corporations from emerging economies might give a glimpse into the future. In a final map we examine the overlap and integration between the networks of high income economy corporations (red) and emerging economy corporations (green). We particularly focus on the strategic “connection nodes”, where both networks integrate with each other (grey dots). We highlighted the fifteen most important connection nodes, where at least two high income economy corporate networks “meet” with two emerging economy corporate networks. If the growth of emerging economy corporations persists, these places might play a key role in the coming decade. Remarkably, the most important “connection node” is Houston, where all fourteen corporate networks have at least one subsidiary, ensuring its future importance as the unofficial capital of the petrochemical industry (and still home to one of the largest petrochemical complexes). Other strategically important places are traditional global power hubs like London and New York, some offshore tax havens (Hamilton (Bermuda) and Road Town (Virgin Islands)), but also a range of hubs in the Emerging Economy countries (such as Shanghai, Sao Paulo and Mumbai). Thus, the places where both networks integrate with each other are located partially in the traditional high income economies of Europe and North America, and partially in the emerging economies of (particularly) Asia and South America. It shows that old networks and structures remain relevant today, aligning with the idea of the continuing Western corporate dominance of the global economy against the background of shifting global production centres. However, our analysis shows this traditional network is definitely supplemented by new spatial structures with new strategic power hubs, allowing for incremental yet transformative change in the global corporate power networks of the petrochemical industry.

It needs to be stressed again that these maps should be interpreted with some caution. Not only is the data itself not completely accurate (because of outdated or false information in the company data set), the analysis itself provides a one-sided perspective on corporate networks. It does not show how important certain ties or places are in monetary terms, nor where the main production centres are located or where most added value is created. However, even though the maps should only be used to get a general overview and observe some global trends, they still provide an interesting insight into the spatial strategies and changing power structures of this polluting but economically important industry.